- Home »

- Knowledge »

- Digital Assets »

- A Closer Look at Ethereum

to read

Ethereum’s origins and value proposition

Ethereum is the second most adopted blockchain, its native cryptocurrency Ether is the second most valuable cryptocurrency by market capitalization[1]. Launched in 2015, Ethereum significantly enlarged blockchain functionality by providing a general purpose blockchain infrastructure. This infrastructure allows a vibrant community of developers and entrepreneurs to develop and run diverse applications including financial as well as non-financial ones.

Thus, the Ethereum blockchain does not only power its native cryptocurrency Ether but also many other tokens, such as stablecoins and DeFi tokens. Ethereum’s general purpose feature is enabled through smart contracts, which are self-executing codes on the blockchain.

Ethereum’s founder Vitalik Buterin describes this main feature in the Ethereum whitepaper[2]:

Ethereum’s use cases

Financial use cases |

Non-financial use cases |

|---|---|

|

Any asset, such as equities, bonds and real estate, can be represented on Ethereum through tokenization. Today, the largest category of tokenized assets are stablecoins. Besides use cases in traditional finance, Ethereum also enables decentralized finance, DeFi, that is financial services which are entirely powered by blockchain protocols. DeFi examples include decentralized lending and borrowing. Example: In 2021, the European Investment Bank issued a 100 million Euro bond on the Ethereum blockchain[3]. |

Ethereum also allows for non-financial use cases. A prominent example are tokenized supply chains which allow for a better audit trail as compared to their off-chain ones, improving traceability and ensuring authenticity. Example: Since 2021, the Italian beer producer Peroni has used Ethereum for its supply chain management[4]. |

What makes Ethereum valuable?

Ethereum derives its value from many features, importantly including the strength of Ethereum’s public blockchain network, its dynamically adjusting supply schedule and its general purpose functionality. Ethereum has attracted a large number of users and a vibrant community of developers, leading to strong network effects.

- Strength of Ethereum’s public blockchain network

The Ethereum blockchain has a – compared to other general purpose blockchains – long track record. Ethereum is built on decentralised blockchain technology. It is distributed across a global network of nodes and does not depend on any central authority. Within the decentralized network, consensus is reached by the proof of stake consensus mechanism. This setup makes it resistant to centralized points of failure and attacks such as hacking or tampering by a single entity. In order for malicious actors to successfully attack the network, they would need to control a significant portion of the staked Ether supply. Its decentralisation brings credible neutrality and resilience to the network. Read section 4 “How does Ethereum work?” to understand Ethereum’s technical setup. - Dynamically adjusting supply schedule

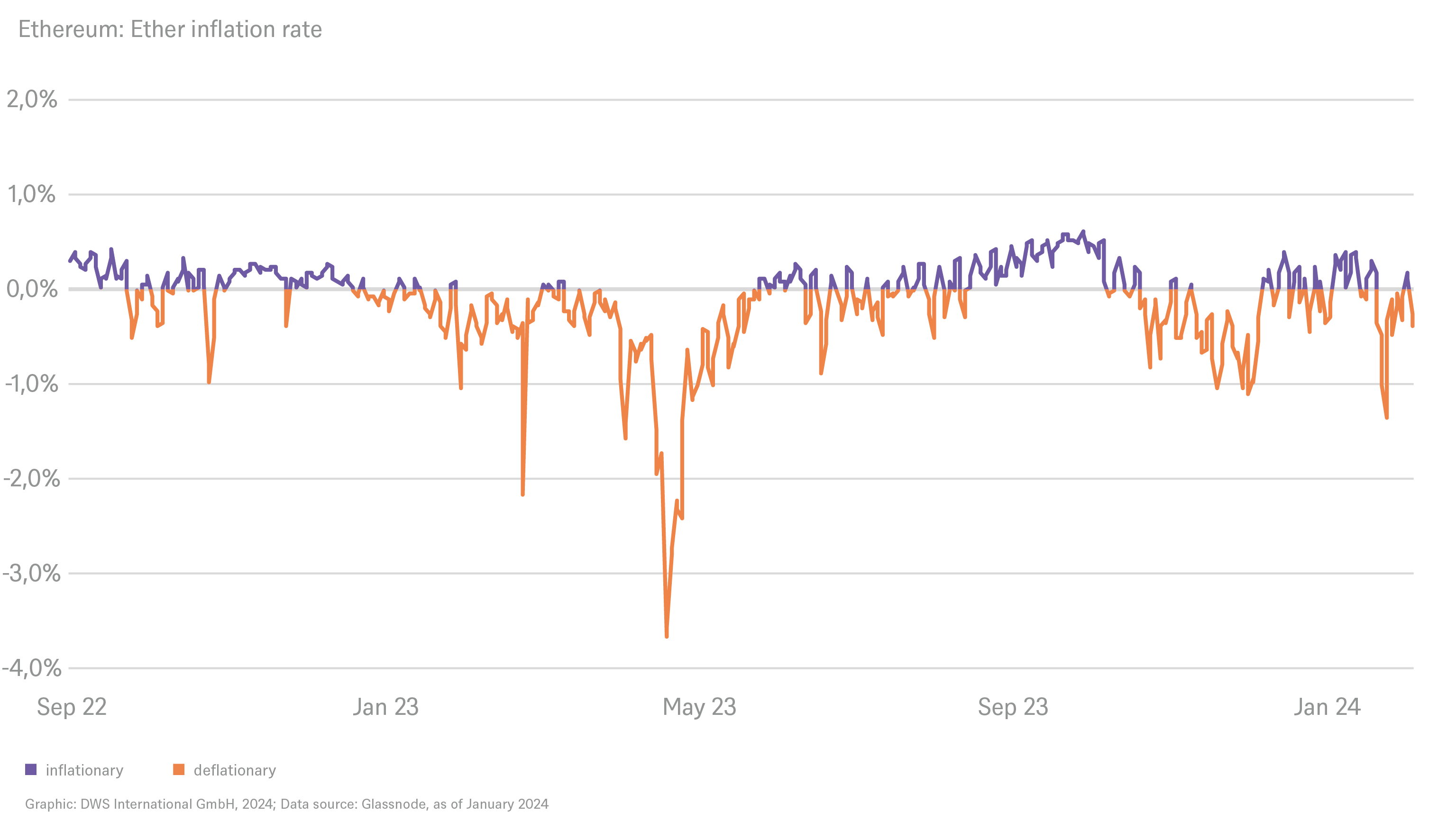

Ether’s supply schedule is neither fixed nor is its supply limited but instead Ethereum dynamically adjusts its Ether supply depending on market demand and security requirements. The supply of Ethereum depends on two parameters, the amount of newly issued Ether and the amount of burned Ether. First, the issuance of new Ether depends on the staking demand: A higher staking demand increases while a lower one decreases the issuance of new Ether. Second, the base fee of each transaction gets burned. With increased network activity the base fee, and thus the amount of burned Ether, rises. Thus, Ether supply can be inflationary, when the amount of newly issued Ether exceeds the number of burned Ether, or deflationary, when more Ether get burned than newly issued. Since a major technical Ethereum upgrade in September 2022, the “Merge”, Ether supply has decreased. - General purpose technology

Ethereum’s smart contract functionality allows for a wide variety of financial and non-financial use cases. Instead of being enacted by a centralized party, smart contracts automatically validate the terms of an agreement and execute it. Once deployed, smart contracts are unmodifiable. Smart contracts enable many efficiency gains but also entail risks such as technical and fraud risks. With the largest decentralized app developer community, Ethereum can offers many opportunities for innovation and collaboration. Its robust infrastructure and proven track record make it the preferred choice for developers seeking to build decentralized applications.

Did you know fact cards:

- Ethereum was ideated by programmer Vitalik Buterin in 2013 and launched in 2015.

- Ethereum transitioned from Proof-of-Work to Proof-of-Stake in 2022, reducing electricity consumption by more than 99%[5].

- Ethereum hosts more than one million daily transactions, with more than 3,000 applications built on the blockchain[6].

- On average a new block is created every 12 seconds[7].

- Transaction fees on Ethereum are also called gas fees and are usually quoted in gwei. One gwei is one-billionth of an Ether, meaning 0.000 000 001 ETH[8].

How does Ethereum work?

Decentralised blockchains are organised in a network where the network participants neither know nor trust each other. The participants’ method of finding consensus is vital for the network’s secure functioning.

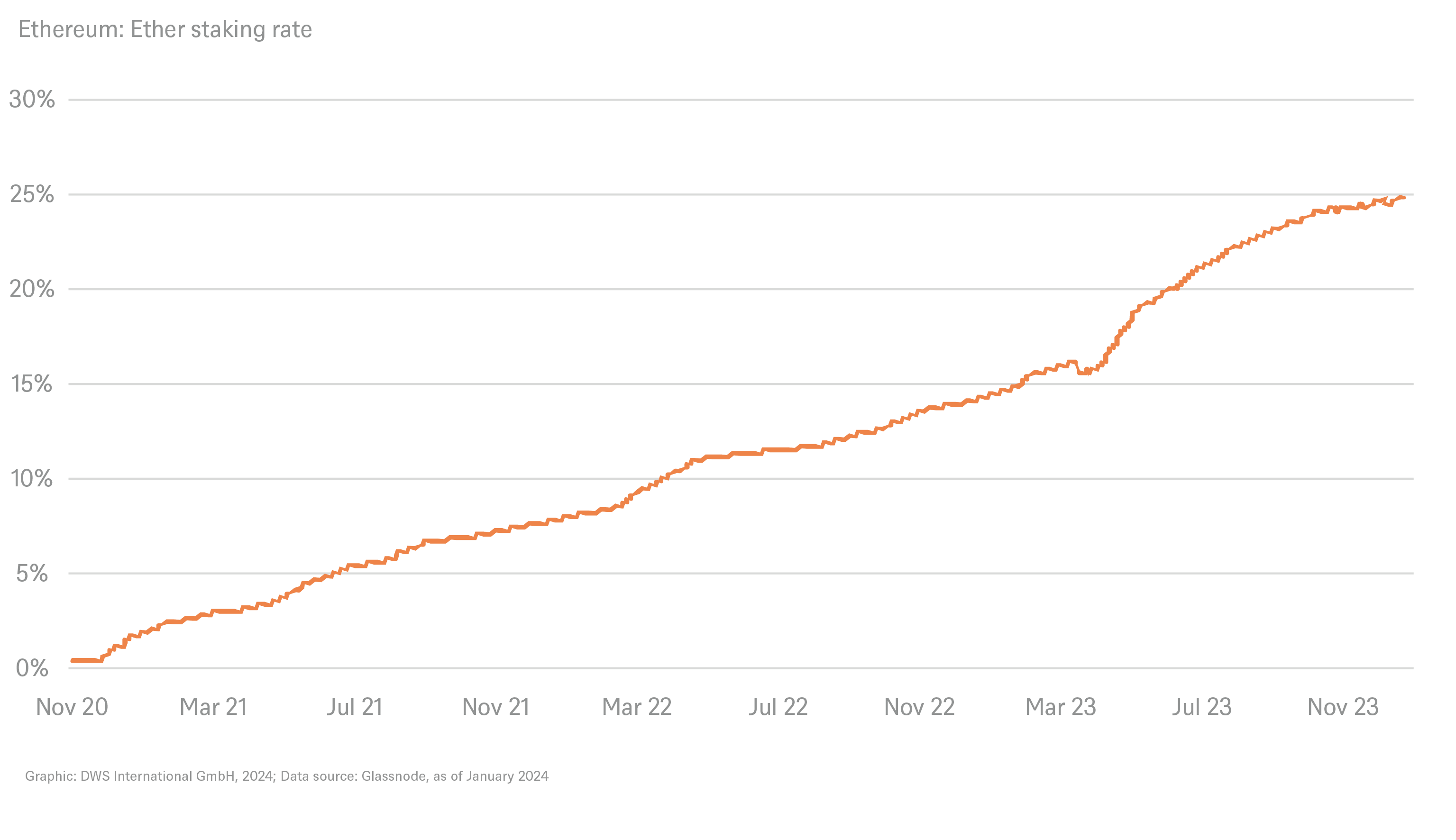

The Ethereum network relies on the "Proof-of-Stake (PoS)" consensus mechanism. Proposed transactions are grouped in a new block. Network consensus on the validity of the new block has to be obtained before it can be added to the Ethereum blockchain. Certain network participants called “validators" are incentivized to validate new blocks. In order to be allowed to participate in the validation process, they have to lock up at least 32 Ether as collateral. Validators receive rewards for truthfully participating in the validation process but are penalized in case of fraudulent behavior through loss of the collateral. Validators are randomly selected but staking more Ether increases the likelihood of being chosen. Once a block has been proposed by a validator, other validators must confirm the block’s validity during a so-called voting period. As of January 2024, approximately 25% of total Ether supply was staked[9]. Generally, Ethereum’s network security increases with higher total staking rates, i.e., the percentage of total Ether supply which is staked.

Validators are incentivized by receiving a “staking reward” consisting of two main sources of revenue, namely consensus rewards and execution rewards. First, consensus rewards incentivize consensus participation, which means either adding or attesting blocks. Second, execution rewards, also called “tips”, come from the priority fee paid by users who wish to speed up their transactions. In 2023, the average staking yield, earned from consensus and execution rewards, was 4.5%[10].

Ether’s role in the Ethereum network

To record a transaction on the Ethereum blockchain, a transaction fee needs to be paid in Ether. Thus, increased Ethereum usage drives Ether demand.

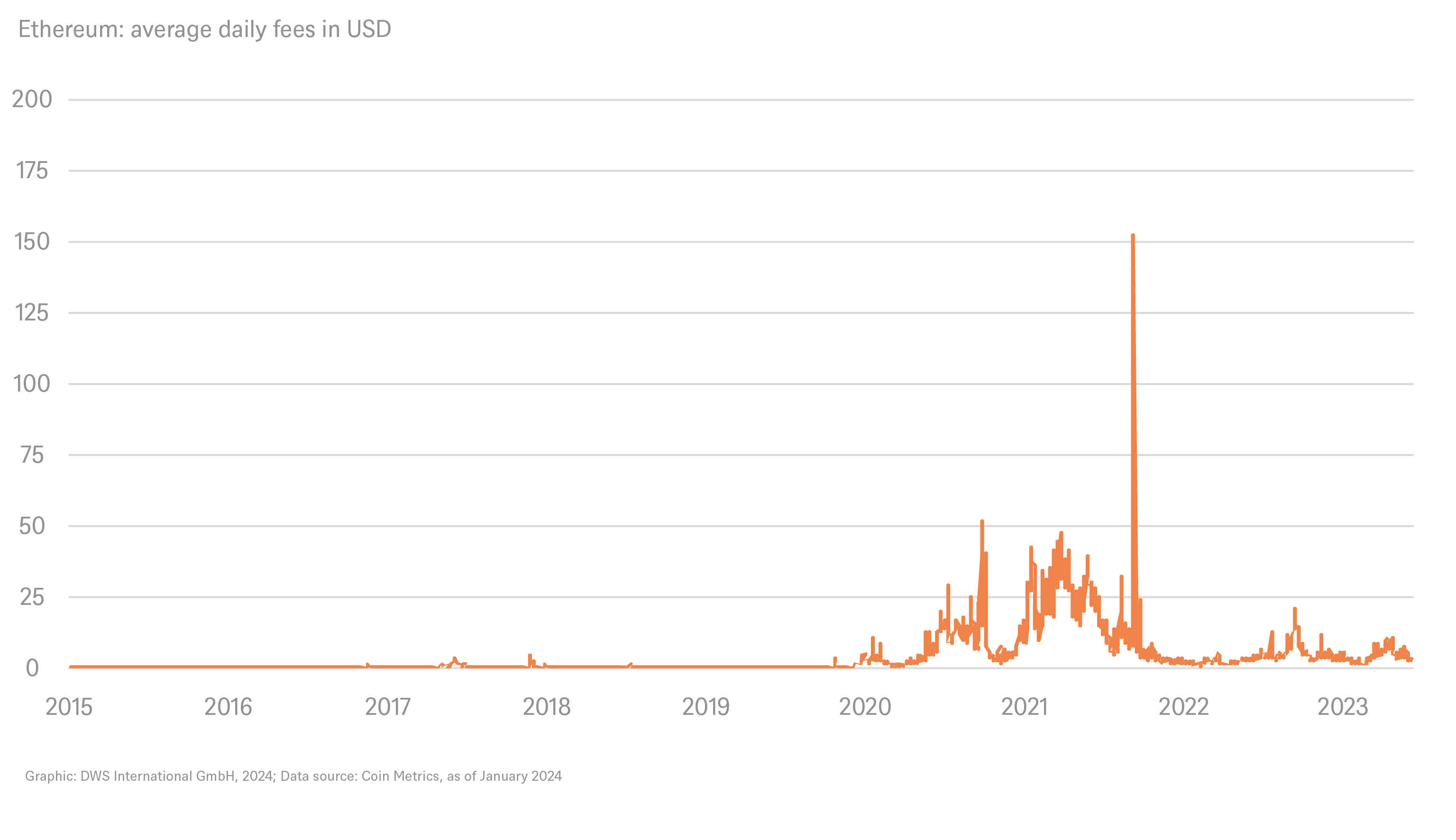

Ethereum transaction fees have fluctuated significantly over the past years. Similar to oil's correlation with economic activity, Ether demand depends on the fluctuating demand for block space on the Ethereum network. Between 2021-2023, the average of all daily transaction fees was 12.51 USD, ranging between 0.97 USD in October 2022 and 200.27 USD in May 2022[11].

Common controversies

New “Ethereum killer” blockchains will make Ethereum obsolete

The Ethereum blockchain, like any other blockchain, has to balance conflicting goals. In particular, there are concerns about Ethereum’s smart contract security, high fees, and slow transaction throughput. Ethereum profits from a vibrant developer community, which is constantly upgrading the protocol to address these concerns. Undoubtably, Ethereum today maintains its position to be the world’s most popular general purpose infrastructure blockchain[12]. Its strong network effects protect its market position but in the still young and quickly evolving cryptocurrency ecosystem, other cryptocurrencies may gain more traction in the future.

Ethereum is not scalable and won’t be able to support scaled use cases

Ethereum developers are increasing the blockchain’s scalability through layer-2 rollups, that is protocols built on top of Ethereum. Rollups process transactions on their own protocol and only rely on layer 1 for transaction finality. Today, rollups already multiply Ethereum’s transaction throughput. While rollups significantly increase Ethereum scalability, the security of layer 2 transactions is generally lower than that of layer 1 ones. You can read more about different blockchain layers here.

Ethereum is not sufficiently decentralised

There are many ways to measure a blockchain’s degree of decentralisation. Three important metrics of decentralization are diversity of client software, geographic distribution of nodes, and concentration of supply. First, Ethereum has a diversified range of client software that can be used to connect to the network. Most blockchains are operated through one primary client while Ethereum relies on more than eight. Second, Ethereum nodes are distributed across multiple countries and continents[13].

Third, Ether supply distribution has been a source of criticism and debate since its launch. Approximately half of the total Ether supply in circulation in 2023 has been issued through a pre-mine, meaning an initial coin offering before launch[14]. Original holders selling and the proof-of-work mechanism have decentralized Ether supply over time, which is vital for its value and Ethereum’s network resilience.

Proof-of-Stake (PoS) is superior to Proof-of-Work (PoW) because it is much more energy efficient

Each consensus mechanism has advantages and disadvantages, which need to be weighed against each other. The core task of a consensus mechanism is to ensure the blockchain’s security which is fundamental for any blockchain to operate. From an energy consumption perspective, PoS is superior to PoW as it only requires a fraction of the energy. However, energy consumption is an important but not the only factor that must be considered when weighing the pros and cons of different blockchains.

Cryptocurrency specific risks

Risk types |

Risk type description |

|---|---|

| Cryptocurrency price volatility | High intra-day price volatility of cryptocurrencies may result in potential losses for investors |

| Blockchain technology risk | Nascent blockchain technology may result in system disruptions, cyber security risks, source code risks, hacking attempts, forks, problems relating to activity peaks, etc. |

| Regulatory and policy risk | Ongoing changes in regulations and policies in relation to cryptocurrencies may lead to adverse impacts for investors |

| Counterparty risk | Crypto brokers and counterparties (e.g., cryptocurrency custodians) may be less established compared to traditional counterparties |

| Liquidity risk | Instability in cryptocurrency markets may lead to (temporary) illiquidity of underlying assets |

| Adverse Environmental and Social Impacts (ESG) | Certain cryptocurrency features such as the consensus mechanism may lead to adverse environmental and social impacts |

| Fraud risks | Cryptocurrencies may be used for criminal activities (e.g., ransom software, money laundering, terrorism financing) |

| Operational disruption | Immature processes in combination with above general risks (e.g., blockchain technology risk) may lead to operational disruption and risks |

Source: DWS International GmbH as of 03/2024

What is Ethereum?

Ethereum is currently the second-largest cryptocurrency blockchain. Learn more about its general-purpose blockchain infrastructure as well as its native cryptocurrency Ether.