The Capital Markets team is positioned centrally between ETF investors and the liquidity providers in Xtrackers products.

Our aim is to maximise fund liquidity and minimise client transaction costs in Xtrackers ETFs.

Capital Markets Capabilities

ETF Trading – How are ETFs typically traded?

There are four main ways in which an ETF can be traded:

What is the difference between the primary and secondary market?

The primary market is the mechanism for the creation of new ETF shares or the redemption of existing ETF shares. When investors purchase a mutual fund, the transaction is settled with a creation of new mutual fund shares. This same mechanism applies in the primary market for an ETF.

The secondary market relates to all activity in ETF trading outside of the primary market with the transacting of existing shares in issue. This can include over the counter (“OTC) trading or the on-exchange trading activity of an ETF.

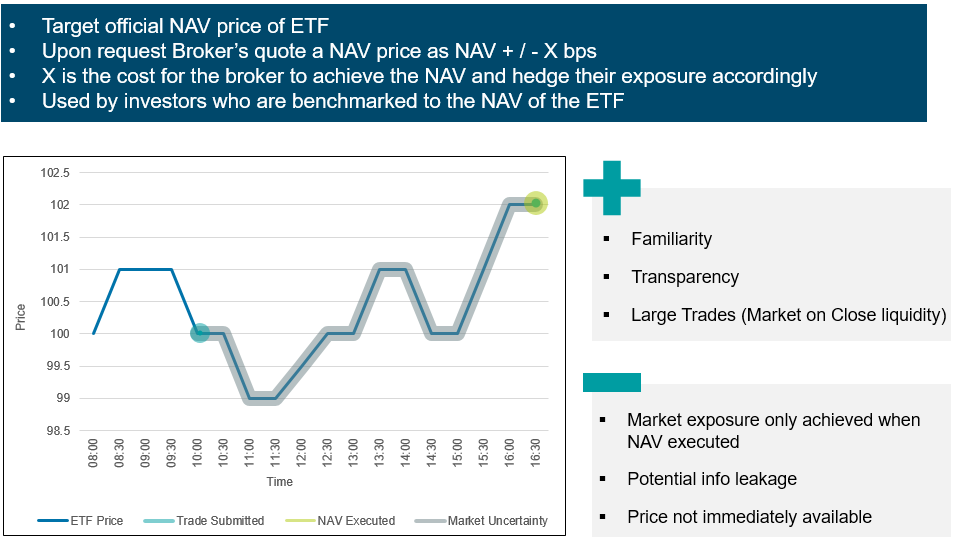

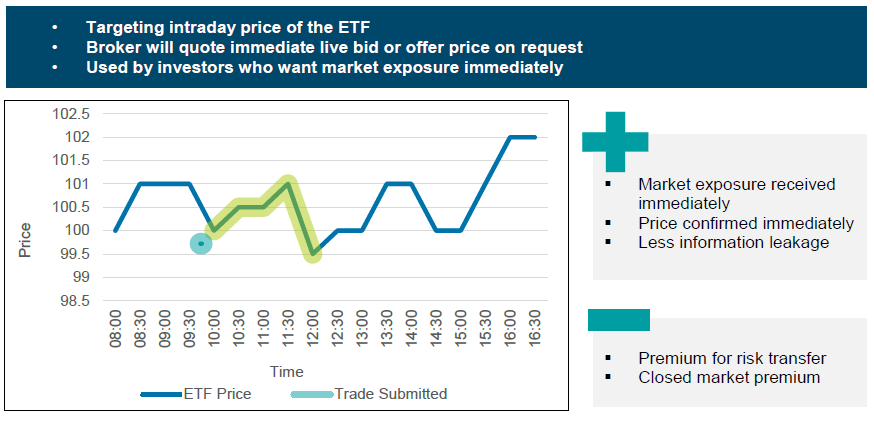

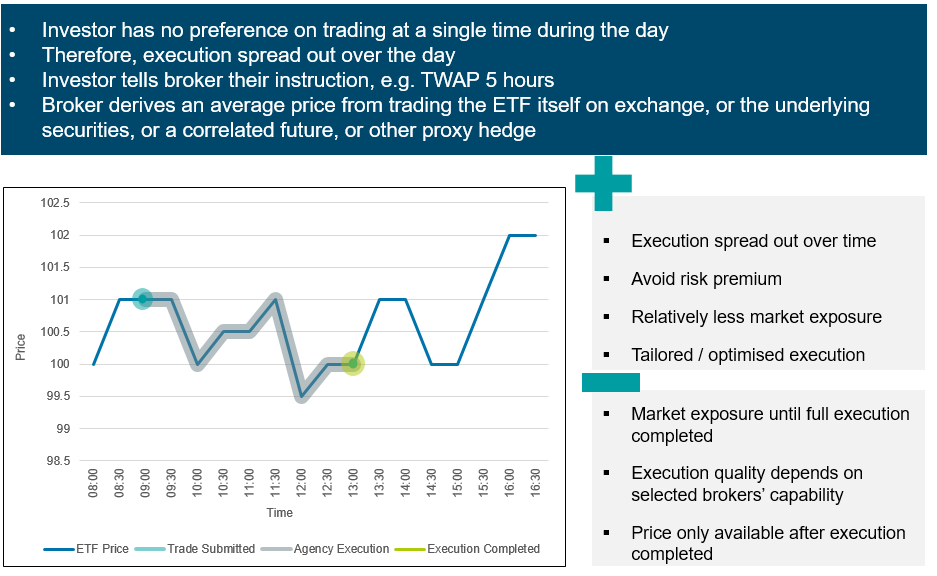

The secondary market provides investors with multiple options for methods of execution with the ability to trade ETFs with live prices, but also verses the Net Asset Value, comparable to trading a mutual fund.

Xtrackers ETFs are listed across major exchanges but can also be traded off exchange via various OTC venues.

FAQs

How do you measure primary market liquidity?

Primary market liquidity is a function of the average daily volume of the ETF’s underlying securities. Common practice is to measure primary market liquidity with a metric called implied liquidity.

What is implied liquidity?

The fundamental driver of ETF liquidity is based upon the liquidity of the underlying securities. ETF implied liquidity looks at how many shares of the underlying would have to be traded to represent the intended trading notional of the ETF. Subject to an investors chosen level of average daily volume (“ADV”) participation this can help determine the volume that can be traded in one day driven by the least liquid security in the trading basket. For example, the maximum amount of participation could be capped at 25% of ADV of the least liquid security, and therefore based on historical average daily volumes investors can derive the number of ETF shares that could be traded based a chosen participation level.

How do you measure secondary market liquidity?

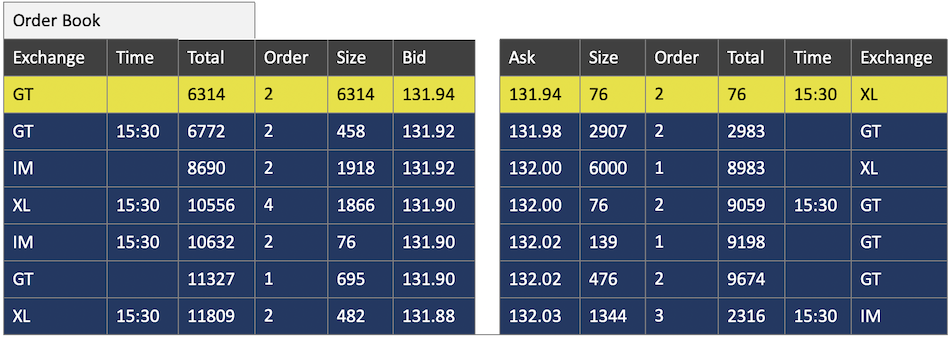

Where implied liquidity of the underlying securities is the ultimate driver of ETF liquidity, it is important to understand that the average daily volume of the ETF itself should not be used as a stand-alone tool to assess the liquidity profile of an ETF. Breaking this down, when a creation or redemption of an ETF occurs in the primary market, it is the transacting of the underlying securities which takes place to facilitate the primary market ETF order and thus a defining metric for understanding liquidity. In addition to this, it is good practice for investors to look at other metrics when selecting ETFs such as but not limited to: ETF exchange bid offer spreads, OTC pricing and market depth.

Who are the most active market makers in specific funds?

The most active market maker(s) in a fund will vary from product to product. We recommend to contact the Capital Markets Desk to connect you with the most active market maker(s) for your specific order.