The simplicity of single bonds in a diversified portfolio

Xtrackers Target Maturity ETFs are innovative fixed income ETFs that have a fixed maturity date. They hold a diversified portfolio of bonds with similar maturities, provide regular income payments and distribute a final pay-out in the specified maturity year. Investors can choose the maturity date that best suits their needs from a range of different options.

Bond investing made accessible

Accessing the market for single bonds is not easy and is expensive[1]. Target Maturity ETFs buy hundreds of bonds at a time. This provides broad exposures to investment-grade corporate bonds and allows investors to build customised portfolios tailored to specific maturity profiles, risk preferences and investment goals.

Xtrackers Target Maturity ETFs combine the best of individual bond and ETF investing: Our product range offers the potential for regular income generation and a final cash distribution at the fund’s expected termination[1].

Investor’s benefits

How Xtrackers Target Maturity ETFs work

During the holding period of an Xtrackers Target Maturity Fund

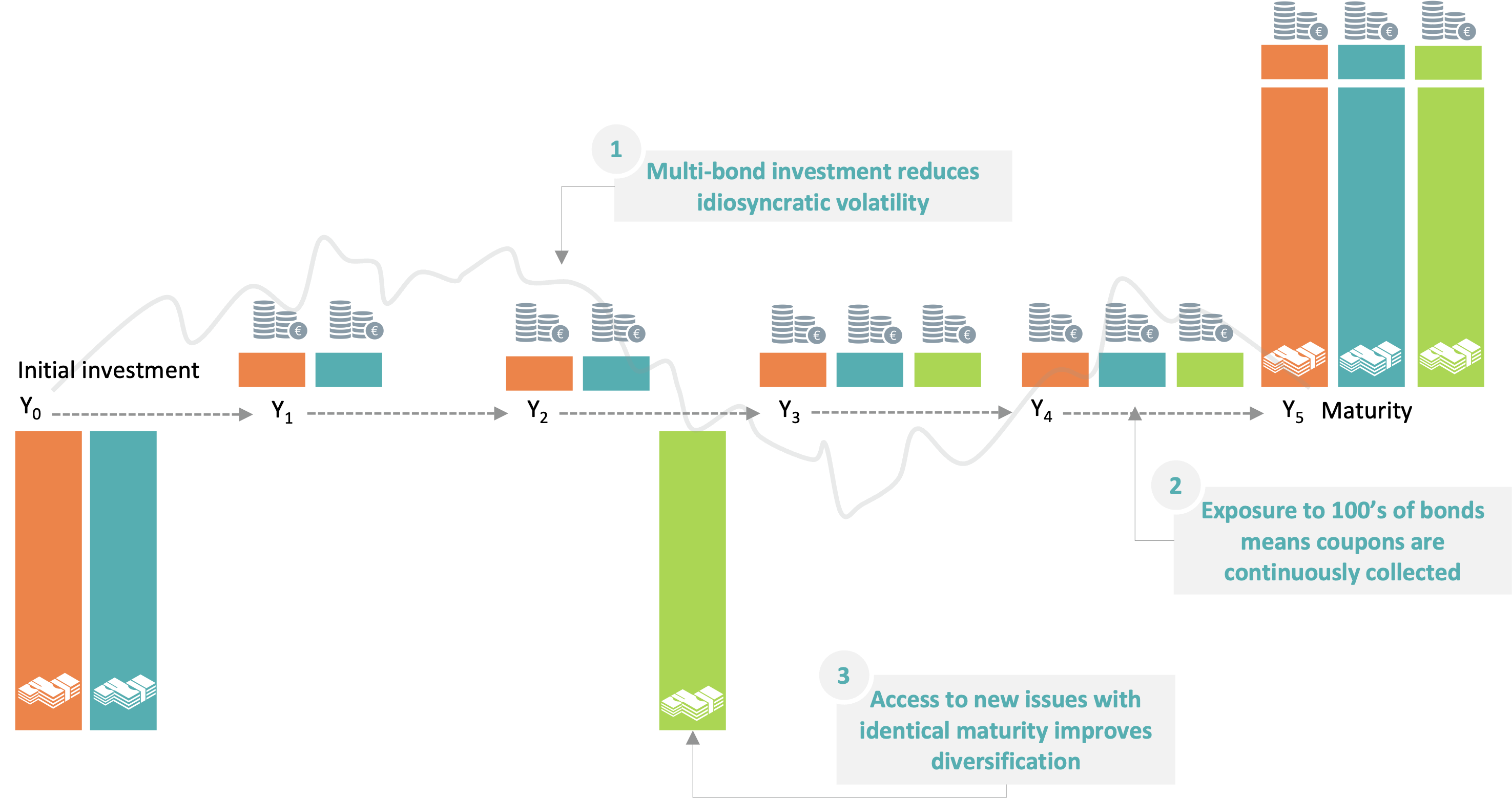

- Broad exposure: These funds are designed to mature on a specific defined “maturity date”; September of a given year, as indicated in the fund’s name. Each ETF is made up of a diversified basket of individual bonds maturing within the twelve months prior to the maturity date.

- Distribution Income: Like many other Xtrackers ETFs distributing income, investors can expect a quarterly income stream from the accrued coupon payments of the underlying bond investments.

A basket of bonds maturing in 5 years

Source: DWS International GmbH

Source: DWS International GmbH

When the Xtrackers Target Maturity ETF matures

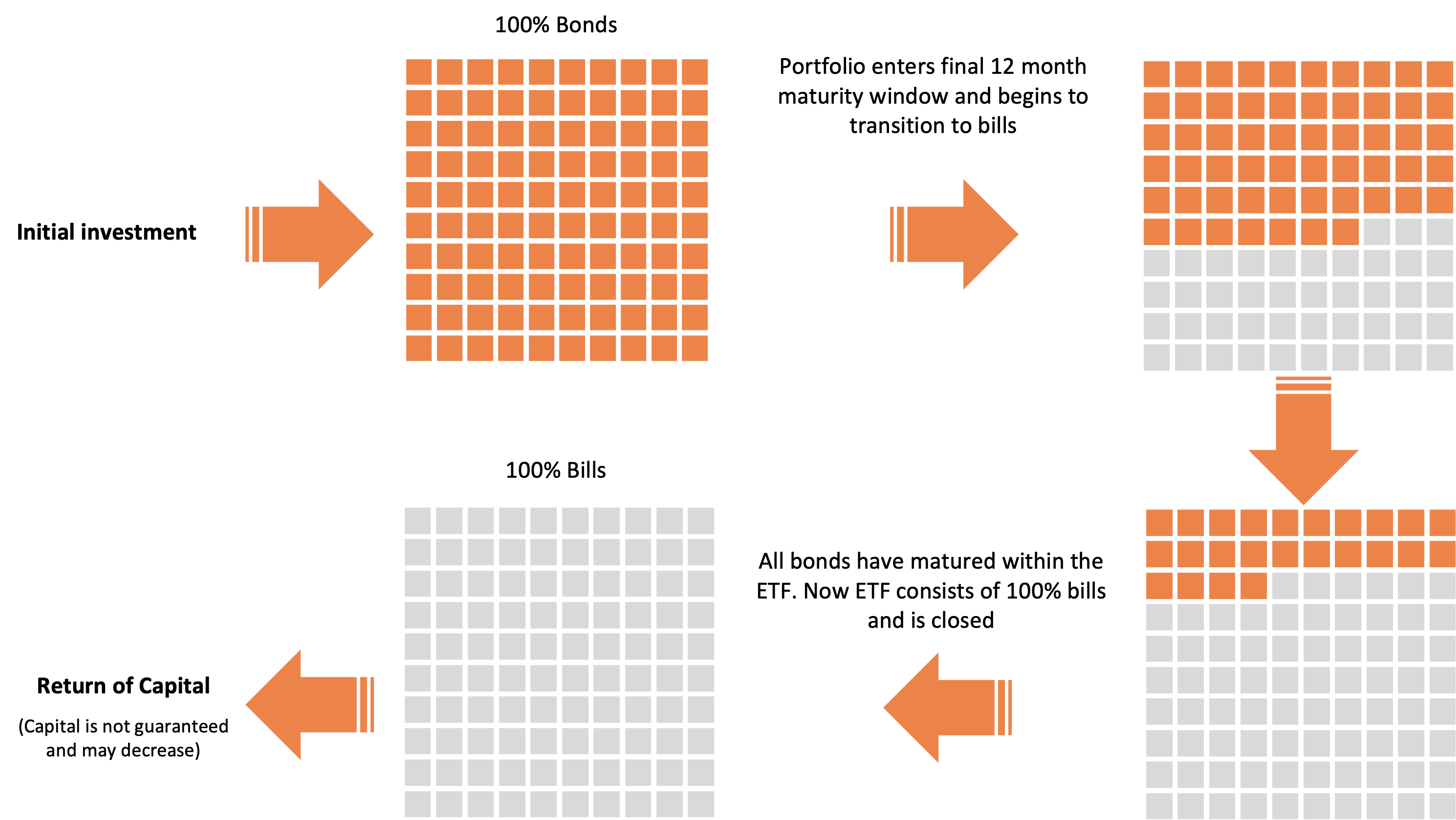

- The final months of the ETF: During the twelve months prior to the maturity date, bonds begin to mature. The cash received from the maturing bonds is reinvested in low-risk Treasury bills at the month end rebalance to prepare for the final pay-out.

- Final distribution: Once all bonds have matured, the ETF is liquidated, and investors receive all remaining fund assets in the form of cash.

What happens as the ETF approaches maturity?

Source: DWS International GmbH

Source: DWS International GmbH

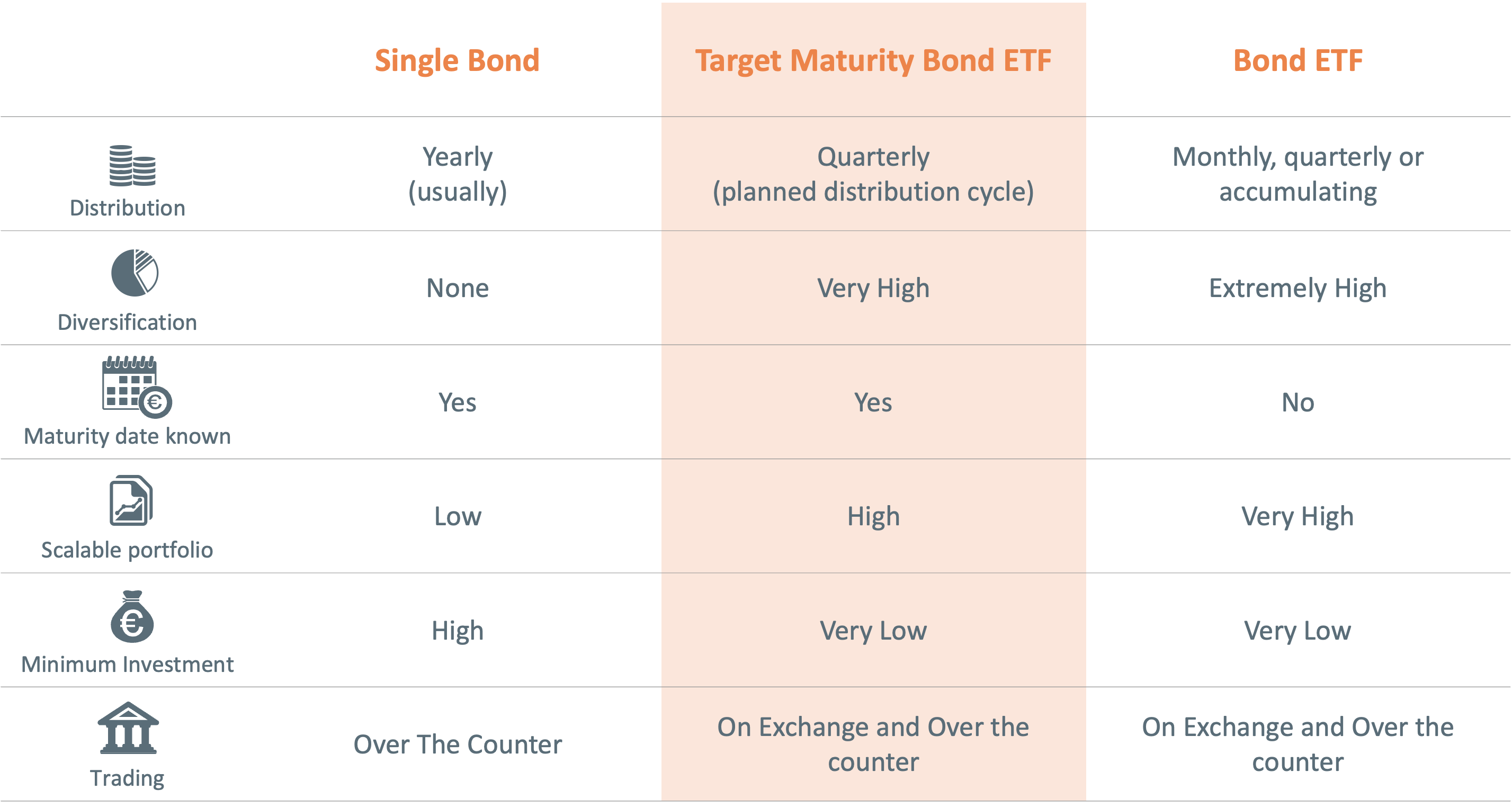

Target Maturity ETFs in comparison

Target Maturity ETFs make life-cycle planning easy. The closer the portfolio is to maturity, the lower the risk as investors harness the power of the "pull-to-par effect"[2]. Traditional fixed income ETFs, on the other hand, are best understood as 'constant' maturity solutions. The following table provides an overview of how Target Maturity ETFs differ from single bonds and conventional fixed income ETFs:

How to use Xtrackers Target Maturity ETFs

Xtrackers Target Maturity ETFs combine the safety and flexibility of single bonds with the liquidity and diversification of ETFs. They can be used for a variety of investment strategies, depending on investor needs, objectives and financial circumstances:

Opportunities & risks at a glance

Opportunities |

Risks[3] |

|---|---|

|

|

Target Maturity ETFs – FAQs

What maturity dates are available?

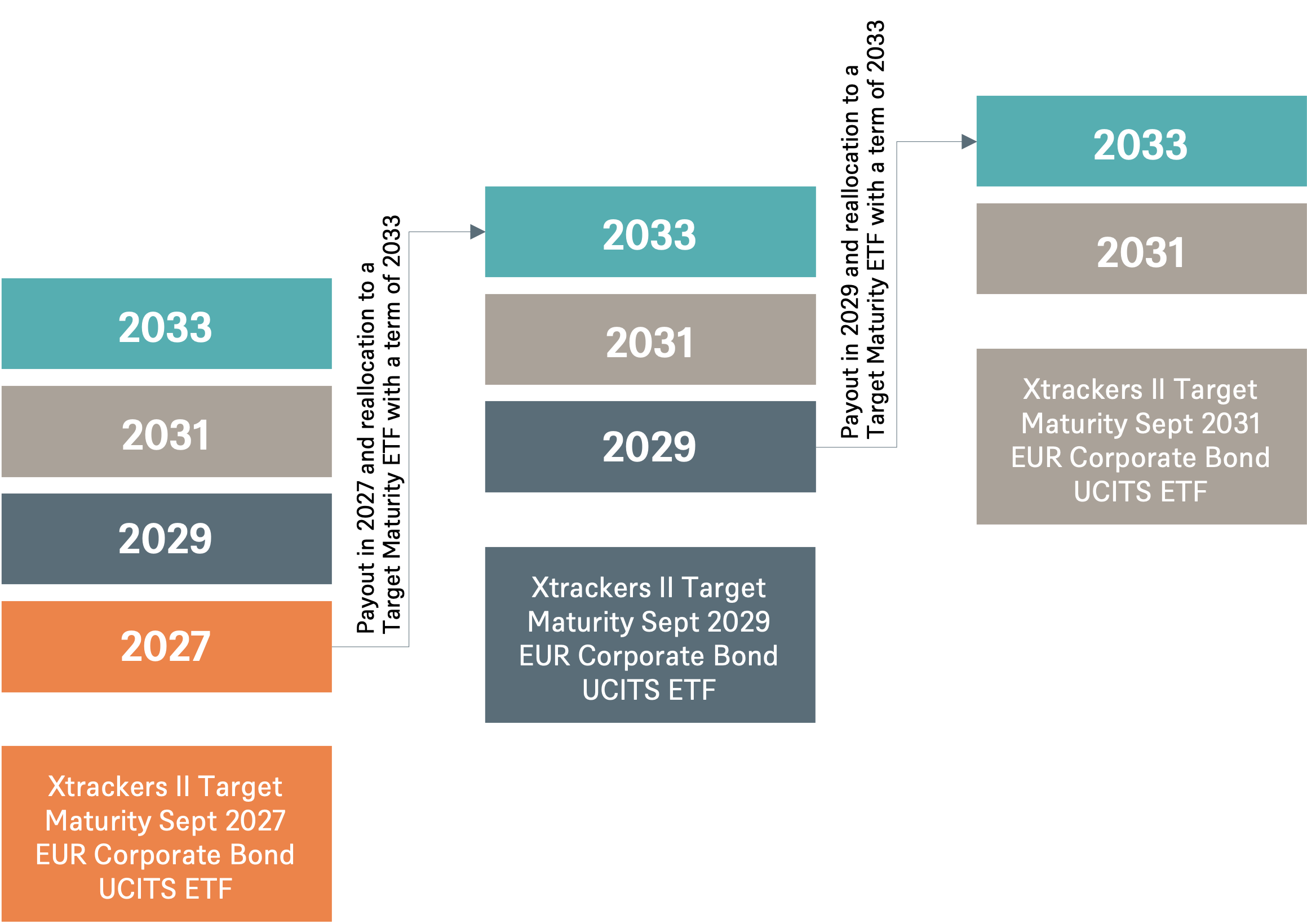

Investment needs and objectives vary amongst investors. Xtrackers offers a range of target maturity dates, as investors may have different investment horizons and may require a return of capital at different times. The available maturities are September 2027, 2029, 2031 and 2033. These allow for shorter- or longer-term investments depending on investor objectives.

When are distributions made and when is the ETF liquidated?

The ETFs aim for quarterly distributions in or around February, May, August, and November of each year. The final distribution takes place in or around September, once all holdings have matured.

Do Xtrackers Target Maturity ETFs have any ESG considerations?

Xtrackers Target Maturity ETFs track the Bloomberg MSCI Euro Corporate September 20XX SRI Indices. These are based on the Bloomberg Euro Corporate Index and apply additional maturity and ESG[4] criteria. Corporate issuers with an MSCI ESG rating of B or higher are eligible, while issuers with a "red" MSCI ESG Controversies Score and issuers that generate revenues in certain business areas are excluded.

Additional information on the index methodology can be found here.

How can Xtrackers Target Maturity ETFs help investors save?

After years of near-zero interest rates, interest rates are back, but traditional bank term deposit rates do not yet reflect these new realities. Target Maturity ETFs offer investors the opportunity to lock in higher yields for up to 10 years while potentially avoiding reinvestment risk.

1. Source: DWS International GmbH | as of October 2023

2. Pull to par - also known as shortening the maturity - is the effect of a bond's price approaching par over time. At maturity, the price should, in the best case, equal its par value.

3. A more detailed description of risks and other general information can be found in the risk section(s) of the prospectus.

4. ESG stands for Environmental, Social and Governance. The three criteria refer to a set of standards to understand and measure how sustainably an organization operates.